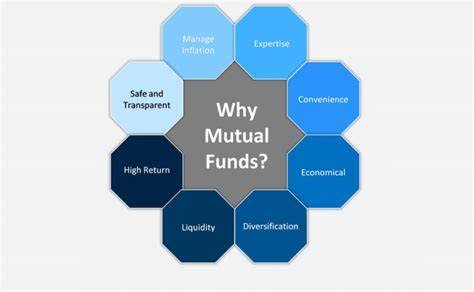

Mutual funds are renowned as investment instruments amassing capital from investors for purchasing securities. Do you find confusion when it comes to –why invest in mutual funds? Well, they allow individuals to access different portfolio of bonds, stocks, or many other assets. Moreover, they eliminate the need to directly administer them. The same attracts several investors prioritizing the ease and expert management that these funds offer.

After being aware of these key facets of capitalizing in mutual funds, it becomes easy to make proper decision and ultimately match investments with proposed financial objectives. Now let’s get fully acquainted with various causes behind mutual funds’ popularity. Such reasons solve the question i.e. – why do people invest in mutual funds.

1) Why are mutual funds popular?

Understanding the popularity clears your confusion on why invest in mutual funds and why mutual funds.

Let’s explore the reasons behind why are mutual funds popular.

The mutual funds’ popularity is gradually strengthening among many investors; here are the reasons that justify the same.

- Mutual funds offer a level of diversification across various asset classes, which helps spread risk and can be particularly appealing in volatile markets.

- Mutual funds are regulated and transparent, providing shareholders with detailed information about their investments.

All these facets make these mutual funds an excellent choice for newbie and experienced investors too.

2) Why invest in mutual funds: Key trends affecting mutual funds

Being aware of the following trends will further clarify your confusion on why invest in mutual funds.

Currently, several key market trends are influencing the mutual fund landscape:

The mutual fund industry is always changing, influenced by different market trends and shifting investor preferences. Understanding these trends can give us valuable insights into how the industry is currently working. Here are some important things to know:

1) Investor preferences:

Investors are becoming more conscious of their investment choices and seeking funds that align with their values or specific goals.

Investors today want more specialized funds that fit with what they care about. The examples include:

SRI (Socially responsible investing) allows investors to research funds that back aspects like social justice or environment.

Thematic funds emphasize on renewable energy or technology.

These kinds of funds have become more popular recently.

2) Technological advancements in fund distribution:

Technology has been a big part of making changes in the mutual fund industry. Two important ways this has happened are:

Digital platforms that let people invest online

Robo-advisory services utilize computer algorithms to provide advices on investment

Such aspects have streamlined people for researching, comparing, and investing in mutual funds

3) Specialized funds in demand:

Those funds that emphasize on renewable energy, or use social/ environmental/governance aspects in their investment verdicts are growing in popularity.

4) Regulatory Changes:

Government organizations still have an important role in how mutual funds work. If rules modify, it can impact aspects like the amount people need to pay in fees or the type of information companies need to share. Such trends depict that the mutual fund market is dynamic, and investors must stay abreast with the latest trends.

Other influencing factors:

- Macroeconomic factors

- Changes in regulations

- Shifts in investor sentiment

Fund managers and investors must understand these funds while exploring the dynamic landscape of mutual funds.

3) Why invest in mutual funds: Advantages

The advantages that mutual funds provide make them an enticing investment alternative. The below points clarify on why is it good to invest in mutual funds.

i. Diversification:

Diversification justifies why is it good to invest in mutual funds. The investment in diverse portfolio facilitates investors with an easy access to various kinds of assets. They need not choose and handle individual investment.

ii. Professional management by experienced fund managers

Expert fund managers experienced in choosing and handling various investments look after mutual funds. They carry out thorough research and evaluation to spot investment opportunities and then guide investors. Their specialized knowledge and experience keeps investors free from qualm about why invest in mutual funds.

iii. Access to Various Investments

Individual investors can easily access various types of investments presented by mutual funds. Certain mutual funds are proficient at capitalizing in global markets or certain sectors. So, investors need not deal with complexities or carry out in-depth research.

iv. Transparency and highly regulated shareholder information

Mutual funds follow rigorous rules that demand investors to regularly provide updates and even revelations to their shareholders. The included information revolves around the fund’s performance, expenses, holdings, and any modifications in investment tactic.

Investors can easily access the information by using reports, catalogues, and other formal documents. The offer transparency facilitates investors to wisely decide about precise and recent information. It is what gives investors a clear idea on why mutual funds.

4) Types of Mutual Funds

Each type fulfils a unique objective and requirement of investment. Now let’s get a comprehensive overview on the commonly available categories of mutual funds.

i. Equity:

Primarily, equity funds invest in either stocks or shares of corporations. Such funds can be then classified depending on following aspects:

Market capitalization (large-cap/mid-cap/small-cap)

Investment method (value, growth)

Sector-specific focus (healthcare, technology)

Equity funds provide opportunities for more returns and also present more risk. It may create confusion regarding why are mutual funds going down.

ii. Bond Funds:

Bond funds chiefly capitalize in fixed-income type securities i.e. government bonds/corporate bonds/municipal bonds. They assure regular income stream via interest payments. Usually, they are less risky than equity funds.

iii. Balanced Funds:

Also called hybrid funds or asset allocations, balanced funds intend to strike a balance between fixed-income securities and equities. They facilitate diversification across both types of asset classes. They are best choices for investors looking forward for an average level of risk & return.

iv. Index Funds:

These funds intend to the performance of a particular market index (like the FTSE 100 or S\&P 500). They present cheap costs and intend to provide returns aligned with the benchmark index.

v. Specialty Funds:

They emphasize on specific sectors that may go viral in the market. They provide investors with an opportunity to capitalize in niche areas and on evolving trends.

Investors much meticulously assess their investment objectives along with risk tolerance prior to choosing a mutual fund. This approach helps them correctly fulfil their needs. If you are investor looking for a regular stream of income of long-term growth or access to specific market landscapes, you can choose a precise mutual fund fulfilling the needs.

Conclusion:

Before capitalizing in a preferred mutual fund, it is necessary to consider the investment goals and risk tolerance. The corresponding market is dynamic but mutual funds are till practicable long-term type investment alternative. If you are uncertain about why invest in mutual funds then you must learn the benefits to understand its worth. Consequently, you can make a wise investment and benefit from high returns. You can check out offerings from BeWealthy to wisely invest in mutual funds.

FAQs

Investor looking for mutual funds can clear their confusions with the help of following section on frequently asked questions.

1. How shall an investor pick up the most appropriate mutual fund?

The selection of appropriate mutual fund relies on an investor’s investment objective, duration, and risk tolerance ability. You can consider the following factors:

- Determine whether you are seeking growth, income, or a combination of both.

- Assess your risk tolerance to determine if you are comfortable with conservative, moderate, or aggressive investments. The risk assessment will justify why mutual funds are going down.

- Review historical performance and compare it against relevant benchmarks to evaluate a fund’s track record.

- Consider the expense ratio and other fees associated with the fund. Lower costs can positively influence long-term gains.

2. Can I cash in my shares whenever I want?

Mutual funds’ liquidity enables investors to get back their shares anytime they wish. It is possible to redeem shares if you are uncertain about why are mutual funds dropping. The mutual fund shares’ sale hinges on the net asset value totalled at the particular trading day’s termination.

3. How is tax calculated on investment in mutual funds?

Mutual funds allot taxable capital gains along with dividends to stockholders. The capital gains taxes may need to be paid if you sell out your mutual fund shares. In case your mutual funds are in either a 401(k) or an Individual Retirement Account (IRA) or a 401(k), you are exempted from paying the taxes until you have extracted funds from the particular account.